بایگانی دستهها: Housing market great tips

Kathleen Wynne must create a new tax now!

According to the new report by «Toronto Real Estate Board» average price of a condo in GTA passed well above $500,000.

Now what? Who must be blamed? Investors? Speculators? Or non-residence buyers? Who must pay the next tax? Out of 54,813 total resale transactions reported by TREB in the first half of the year 15,474 condo units changed hands. Knowing that most of the pre-construction condo sales are not reported on MLS, the condo share is more than 35% of market activities. Despite the recent decline in overall sales, condo market was resilient compare to low-rise market. Now condo is no more affordable for a family with an average income in GTA.

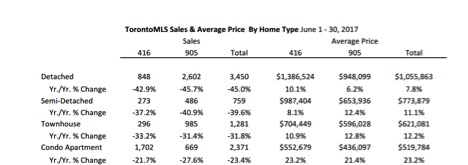

The table below is part of the TREB’s report for second quarter of the year, when the new «housing fair plan» from Ontario Liberal government for cooling the market down has been in effect.

In the city of Toronto the average price of a condo is well over $566,000.

And here is part of TREB’s most recent report regarding rental market:

“It is clear that we continue to suffer from a lack of available rental units. The Fair Housing Plan announced by the Government of Ontario committed to measures designed to increase housing supply. Conversely, the Fair Housing Plan also expanded rent controls, which could preclude investment in rental properties, thereby further constricting supply. With different policy components potentially at odds, it will be interesting to see the eventual impact of the Fair Housing Plan on the rental market in the GTA,” continued Mr. Syrianos. The average one-bedroom condominium apartment rent was up by 8.8 per cent year-over-year in the second quarter to $1,861 per month. The average two-bedroom rent was up by 8.7 per cent to $2,533.

The graph below shows the new homes price changes. Price of new condos started catching up since 8 months ago after years of being almost flat.

Is it a right time for municipalities & provincial governments to understand the demand, reduce the construction costs & charges, encourage building new homes to increase the supply and creating job opportunities? Or inventing a new tax & blame purchasers to eliminate the demand?

I’m not a politician, so I don’t get it!

Feeling the Double Tax Burn?

I was with one of my good and loyal clients today. He wanted to buy an old bungalow in the Willowdale neighbourhood up to Steeles Ave. to demolish and build his dream home. I got couple of appointments in the $1.5M price range.

When I was ready to go out of my office and meet him, he called me and said he had changed his mind and wants to buy a newly built home. He also e-mailed me couple of MLS numbers that he had found on the Internet and asked me to book those new homes for him. So our appointments switched to the $3M price range.

Before I go any further, let me tell you that all four homes that we saw had some kind of a garage problem! I mean you couldn’t fit two SUVs inside these garages easily. Houses in this new price range seem to skip on any blueprint or drawing! For example in one house the main floor is elevated 3 feet from the street. So there were several steps in the garage to enter the home.

The steps were right in the middle dividing the garage floor into two sections. But spaces left at each side of steps were not wide enough to accommodate parking space for a SUV or van. Your expectation from a $3M home is more, isn’t it?

This however is not my main point! On our way back I asked my client if he knows how much land transfer tax he has to pay since our purchase budget has now increased to three million dollars. He said yes and its about $65,000. I said but in the city of Toronto he has to pay double!, so it totals to about $130,000! He didn’t believe it at first but our quick research proved my point. So he said to broaden our search to include city of Vaughan, Markham or Richmond Hill. This will allow him to buy a larger home with the same budget while saving $65,000 tax!

Do you know when one recognizes the importance of having a good realtor?

It’s when you don’t have one! My clients never feel it!

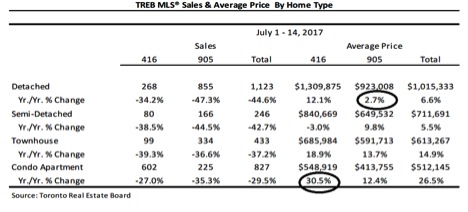

July 2017 TREB Mid-Month Statistics

July 20, 2017 – Greater Toronto Area REALTORS® reported 2,670 residential transactions through TREB’s MLS® System during the first 14 days of July 2017. This result was down 39.3 per cent compared to the same period in 2016. The greatest year-over-year decline in sales was noted for the detached market segment. The lowest annual rate of decline was noted for the condominium apartment market segment.

The number of new listings entered into the system was up by 6.5 per cent year-over-year. While still up compared to last year, the annual rate of growth for new listings has declined markedly, from over 40 per cent in mid-May, and over 20 per cent in mid-June, to less than seven per cent in mid-July.With sales down and new listings up year-over-year, the market was better supplied compared to last year. This translated into a more moderate 6.5 per cent annual growth rate for the average selling price, which was $760,356 for all home types combined. When breaking down average price growth by geography, an interesting dichotomy has developed between the City of Toronto and the surrounding ‘905’ area code regions for some market segments.

The number of new listings entered into the system was up by 6.5 per cent year-over-year. While still up compared to last year, the annual rate of growth for new listings has declined markedly, from over 40 per cent in mid-May, and over 20 per cent in mid-June, to less than seven per cent in mid-July.With sales down and new listings up year-over-year, the market was better supplied compared to last year. This translated into a more moderate 6.5 per cent annual growth rate for the average selling price, which was $760,356 for all home types combined. When breaking down average price growth by geography, an interesting dichotomy has developed between the City of Toronto and the surrounding ‘905’ area code regions for some market segments.

The annual growth rate for the average detached price in the ‘416’ area code was 12.1 per cent, compared to 2.7 per cent for the ‘905’ regions. The annual growth rate for the average condominium apartment price was 30.5 per cent in the ‘416’ area code versus 12.4 per cent in the surrounding ‘905’ regions.

It’s not a bubble, is it?

Since the year 2007 we are hearing here and there some economists warning that Toronto real estate is experiencing overvalued homes and is in a state of a bubble, which will crash and cause a big recession in the size of US recession in the year 2008.

Since the year 2007 we are hearing here and there some economists warning that Toronto real estate is experiencing overvalued homes and is in a state of a bubble, which will crash and cause a big recession in the size of US recession in the year 2008.

They regularly warn that in case of mortgage rate increase, some homebuyers are not able to pay their mortgages. To be honest some potential buyers and investors are waiting for a market crash so they can steal a deal. In mid 2016 when supply decreased and demand increased drastically in GTA, those economic “experts” appeared everywhere and warned us again. This time speculators and foreign buyers were the «prime suspect» for playing with the market and creating a dangerous bubble.

Instead of encouraging builders to increase the supply, create jobs, and boost the economy government ignored this golden opportunity and decided to eliminate demand to earn more taxes – the biggest mistake that authorities made in my opinion.

What happened is the prices are now less than four months ago and number of transactions are 40% less than last year. However there were almost 8000 transactions with average prices of about 7% more than last year similar time in month of June. I can feel the sign of recovery in early July.

Don’t you think if it was a bubble it must have been burst already?

Definitely the worst is over.

Why month of the June was very important in Toronto real estate market?

When suddenly government announced 16 new measurements to cool the market down in late April some Buyers got caught in the middle of buying/selling process. The buyers who had already bought some 30,000 properties in Feb, March, and April in the hottest season ever in Toronto, regretted what they had done after the announcement.

Some got problems with their bank appraisers and financing; and some had to sell their own properties. However after the great psychological effect of new government rules the market cooled down and they had to sell for less than

they expected. Some decided to forget about their deposit and not to close the deal! And some buyers tried to find excuses like the house is smaller than advertised, etc. to get out of their purchase.

The majority of these regretful transactions were supposed to be closed on late June. June historically is the busiest time of the year for lawyers and movers because most of the spring market transactions get closed in late June hence the hot spring market.

Worries rose in May – What if a large number of buyers are not able to close their purchases and a domino effect cause a big market crash?

– The good news is the month of June is gone now meaning no major problem for the market. The problematic transactions either got closed, or mutually solved or even settled in courts. Whatever was meant to happen, it’s over now!

After a big drama imposed on the market such new foreign tax and mortgage industry issues, not only the market did not crash, but also it is showing a great recovery with about 8000 new transactions (in June only).

Definitely the worst is over and new buyers and new sellers are active now and the market is picking up.

Isn’t it a great time to buy in Toronto?

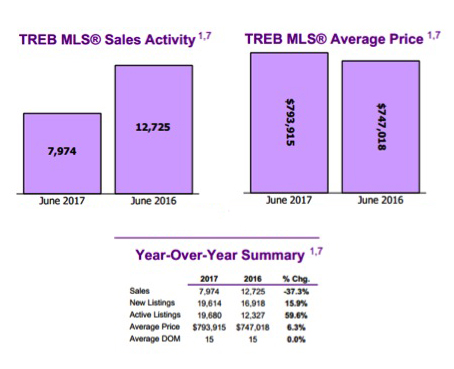

Here is part of the report by Toronto Real Estate for the month of June.

The key part of the report for buyers is the number of active listings which is almost 60% higher than june 2016 while the number of transactions is almost 38% less, it means there are lots of options for the buyers to choose their dream home from.

The price is just 6.3% higher than last year while the average sold price is less than the past four month. So if you are thinking of buying or investing in Toronto, what else you are waiting for?

see what Don Campbell, Senior Analyst at Real Estate Investment Network has to say regarding the Toronto real estate in a short interview please check the link below:

See video here

Happy Canada Day!

Happy Birthday Canada!

What’s the most interesting part of the TREB report?

The table below is part of report regularly being released by-weekly by Toronto Real Estate Board.

First line is about detached homes showing steady and strongly price appreciation in recent years, detached homes have been on demand for years, as many home owners enjoy having a backyard while investors like having more land.

What I believe is that the population of mother earth is increasing constantly yet the size of our planet is not expanding accordingly! So the land per capita is going to be less and less, thus the value of the land goes up and up.

On the other hand government and cities are not encouraging people to own detached homes. It’s not easy for cities to provide services like water, sewer, gas, electricity, etc. to many detached houses compared to a condo complex. This is of course despite the fact that a detached home still can be a better long-term investment for the owner.

But the most interesting part of Treb’s report for me is the last line of the table where Condo market is a strong segment of the market. Whether it is about affordability or changing life styles condos are getting high in demand in today’s housing market. Young professionals love living in or close to the city core having an active life and hating long commutes to work. Shovelling winter snow and mowing lawns is not for them!

Please look at the below table, numbers talk themselves.

Home repairs you should never ignore!

Many people put off repairs in their home. We tend to dodge it and push it off for as long as possible. Everyone realizes that repairs must be done, but other events take a higher priority and often the funds are not readily available. All that said, certain repairs must be done sooner rather than later. These common tasks can lead to greater problems if pushed off for too long.

- A water leak – Leaks can lead to a whole lot of problems if not handled immediately. Constant moisture can cause the wood to rot, mold, dry rot, or termite infestations. Rotting can compromise the stability of the foundation, subfloor, or roofing, leading to very expensive repairs if the foundation or roof buckles. Most importantly, water-related problems can get your home blackballed by insurance companies worried about mold-related claims.

- Peeling paint – Paint is a home’s protection from the elements. It’s the first line of defense against incursions by water and pests. Exterior paint is formulated to protect your house from rain and moisture. If the paint peels, water can seep into wood and lead to rot.

- Unusually high fuel bills – This is more than a money issue. If your heating system isn’t running properly, it can be leaking carbon monoxide. Be sure to have carbon monoxide sensors in your house to alert you if levels are increasing.

- Unusual flickering lights – If your lights are consistently flickering – more than a bulb needing to be changed – then wiring in your house may be off or your circuit board isn’t hooked up properly. Be sure to check on this because it can cause fires!

Rodents – Rats and mice love to chew through just about anything. When it comes to your house, they will chew through insulation and wiring (among other things). This can be dangerous as exposed wires can sometimes cause fires. If they have chewed through wires, be sure to replace them. Certain areas (i.e. theo mountains and hilly areas) are often prone to vermin. If this is the case, try to keep any infestations under control.