I was with one of my good and loyal clients today. He wanted to buy an old bungalow in the Willowdale neighbourhood up to Steeles Ave. to demolish and build his dream home. I got couple of appointments in the $1.5M price range.

When I was ready to go out of my office and meet him, he called me and said he had changed his mind and wants to buy a newly built home. He also e-mailed me couple of MLS numbers that he had found on the Internet and asked me to book those new homes for him. So our appointments switched to the $3M price range.

Before I go any further, let me tell you that all four homes that we saw had some kind of a garage problem! I mean you couldn’t fit two SUVs inside these garages easily. Houses in this new price range seem to skip on any blueprint or drawing! For example in one house the main floor is elevated 3 feet from the street. So there were several steps in the garage to enter the home.

The steps were right in the middle dividing the garage floor into two sections. But spaces left at each side of steps were not wide enough to accommodate parking space for a SUV or van. Your expectation from a $3M home is more, isn’t it?

This however is not my main point! On our way back I asked my client if he knows how much land transfer tax he has to pay since our purchase budget has now increased to three million dollars. He said yes and its about $65,000. I said but in the city of Toronto he has to pay double!, so it totals to about $130,000! He didn’t believe it at first but our quick research proved my point. So he said to broaden our search to include city of Vaughan, Markham or Richmond Hill. This will allow him to buy a larger home with the same budget while saving $65,000 tax!

Do you know when one recognizes the importance of having a good realtor?

It’s when you don’t have one! My clients never feel it!

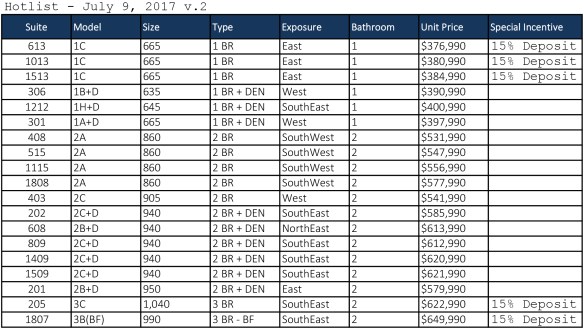

The newest exciting news in Richmond Hill is the launch of

The newest exciting news in Richmond Hill is the launch of