According to the new report by «Toronto Real Estate Board» average price of a condo in GTA passed well above $500,000.

Now what? Who must be blamed? Investors? Speculators? Or non-residence buyers? Who must pay the next tax? Out of 54,813 total resale transactions reported by TREB in the first half of the year 15,474 condo units changed hands. Knowing that most of the pre-construction condo sales are not reported on MLS, the condo share is more than 35% of market activities. Despite the recent decline in overall sales, condo market was resilient compare to low-rise market. Now condo is no more affordable for a family with an average income in GTA.

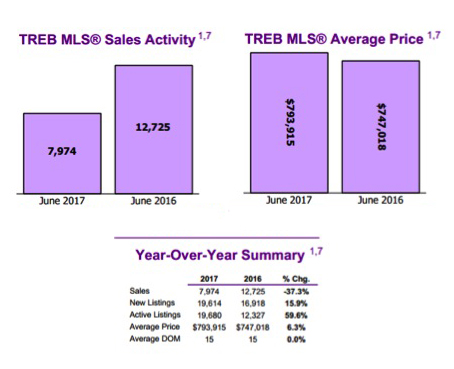

The table below is part of the TREB’s report for second quarter of the year, when the new «housing fair plan» from Ontario Liberal government for cooling the market down has been in effect.

In the city of Toronto the average price of a condo is well over $566,000.

And here is part of TREB’s most recent report regarding rental market:

“It is clear that we continue to suffer from a lack of available rental units. The Fair Housing Plan announced by the Government of Ontario committed to measures designed to increase housing supply. Conversely, the Fair Housing Plan also expanded rent controls, which could preclude investment in rental properties, thereby further constricting supply. With different policy components potentially at odds, it will be interesting to see the eventual impact of the Fair Housing Plan on the rental market in the GTA,” continued Mr. Syrianos. The average one-bedroom condominium apartment rent was up by 8.8 per cent year-over-year in the second quarter to $1,861 per month. The average two-bedroom rent was up by 8.7 per cent to $2,533.

The graph below shows the new homes price changes. Price of new condos started catching up since 8 months ago after years of being almost flat.

Is it a right time for municipalities & provincial governments to understand the demand, reduce the construction costs & charges, encourage building new homes to increase the supply and creating job opportunities? Or inventing a new tax & blame purchasers to eliminate the demand?

I’m not a politician, so I don’t get it!

The number of new listings entered into the system was up by 6.5 per cent year-over-year. While still up compared to last year, the annual rate of growth for new listings has declined markedly, from over 40 per cent in mid-May, and over 20 per cent in mid-June, to less than seven per cent in mid-July.With sales down and new listings up year-over-year, the market was better supplied compared to last year. This translated into a more moderate 6.5 per cent annual growth rate for the average selling price, which was $760,356 for all home types combined. When breaking down average price growth by geography, an interesting dichotomy has developed between the City of Toronto and the surrounding ‘905’ area code regions for some market segments.

The number of new listings entered into the system was up by 6.5 per cent year-over-year. While still up compared to last year, the annual rate of growth for new listings has declined markedly, from over 40 per cent in mid-May, and over 20 per cent in mid-June, to less than seven per cent in mid-July.With sales down and new listings up year-over-year, the market was better supplied compared to last year. This translated into a more moderate 6.5 per cent annual growth rate for the average selling price, which was $760,356 for all home types combined. When breaking down average price growth by geography, an interesting dichotomy has developed between the City of Toronto and the surrounding ‘905’ area code regions for some market segments.